Buying a home is a big step for everyone. It is the biggest investment of your life. Therefore, it is critical to calculate carefully, every step. You need to take into consideration two important factors that can help you save huge on your real estate purchase.

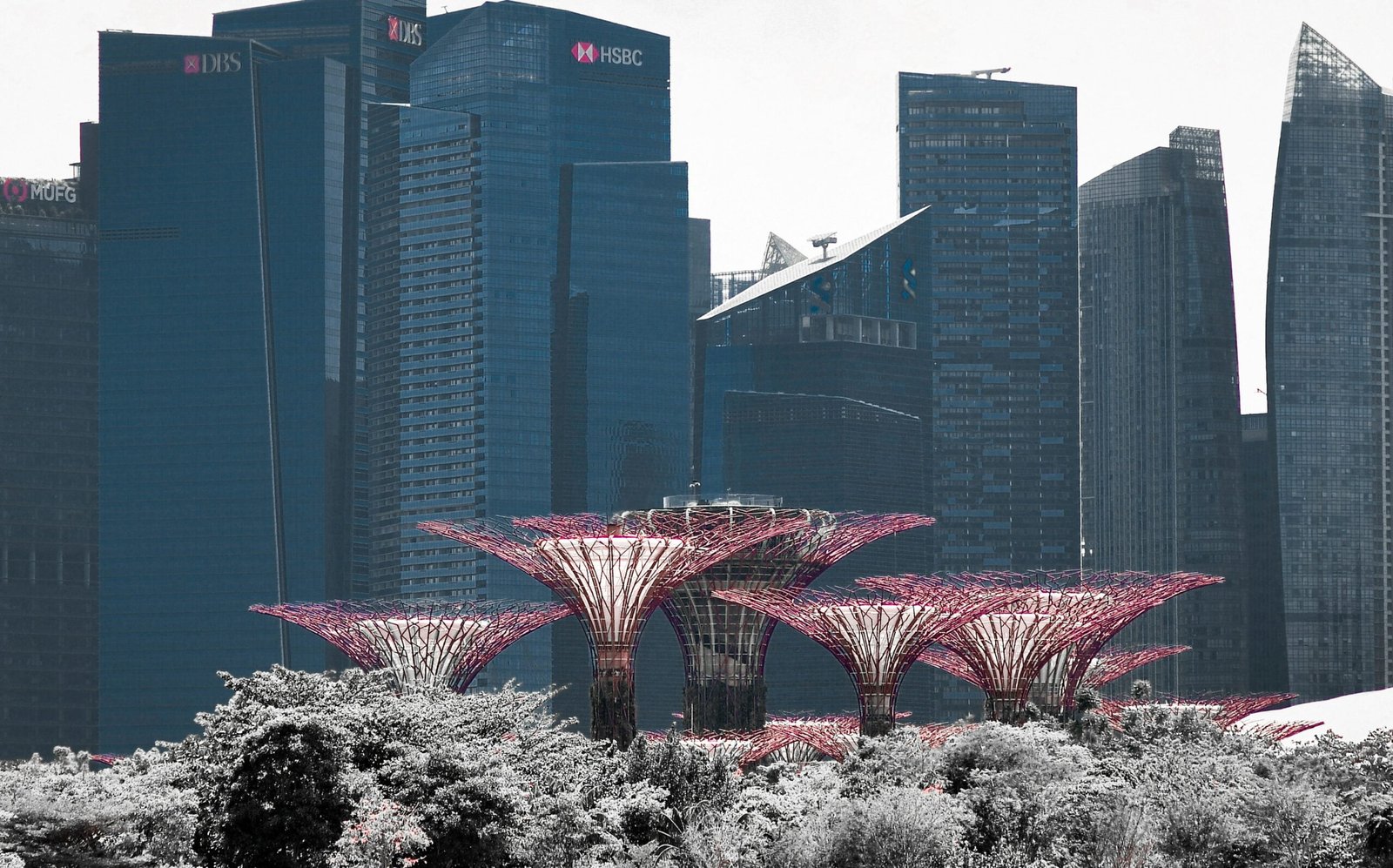

Photo by Nicholson Builders – More exterior home ideas

1. DO NOT OVERPAY

As I mentioned above, purchasing a home is a serious investment for anyone. Therefore, make sure you will not overpay. In fact, this is the first condition when buying a home.

To prevent an overpayment, it is wise to seek the services of a professional. A realtor will guide you and will determine the real market price to be paid.

2. CHOOSE the BEST FINANCING TERMS

Choosing the best financing terms it is another important way to save a lot. Of course, choosing the best interest rate is crucial in setting an affordable and convenient price.

However, there are several other ways of saving and you will be amazed at the amount of money that you can save if you follow these tips.

a) Choose no more than 25 year amortization

First, you need to know that any reduction of amortization term means a reduction of your total payment. In other words, every interest year that you can save means saving a considerable amount of money.

Of course, many mortgage brokers and banks will try to offer you a longer amortization term, 30 or 35 years.

Apparently, a longer amortization term is advantageous for many considering that their mortgage payment is lower, but in a long run, they will pay much more in interest. The real beneficiary of such amortization term plan is only the lender. Finally, who borrow will have to pay a higher price for his home.

b) Choose a weekly or bi-weekly payment plan

Choosing a weekly or bi-weekly payment plan, you shorten the amount of time necessary to pay off the mortgage. In fact, the increasing of payment rate will help you to reduce more quickly the principal.

c) Find a mortgage that offer a prepayment privilege

Many mortgages have prepayment privileges such as an anniversary date. This kind of privilege may be once a year and it can be a great opportunity for you. If you are able to put down an amount of money, you will save a lot.

d) Put a lump sum prepayment down

If you can manage, add few more dollars to your weekly or be weekly mortgage payment.

You will be amazed at how much you could save. Adding no more than $10.00 than is stipulated by your lender will result in saving large sums of money.

Note: All the above considerations may also apply if you are buying a commercial space.

Buying a Vacation Home Considerations | How To Build A House (howtobuildahouseblog.com)