Introduction to Renting Out Your Home

Renting out of your home can be a lucrative means to generate extra income with minimal effort. Whether you have an unused property, are relocating temporarily, or simply want to maximize the value of your investment, turning your home into a rental property offers substantial financial benefits. By leveraging the rental market, homeowners can enjoy a steady stream of supplemental income that can aid in covering mortgage payments, property taxes, and maintenance costs.

One of the primary advantages of renting out your home is the ability to generate passive income. Unlike active income, which requires continuous effort and time, passive income from rental properties can provide financial stability with relatively little ongoing management. This makes it an attractive option for those looking to diversify their income streams without committing to a second full-time job.

Please, read our post and do not forget to check our YouTube channel “Grig Stamate”:

https://www.youtube.com/@GrigStamate

You will find there thousands of designing, furnishing, and decorating ideas for your home interior and outdoors.

Allow me to mention one of them:

House Tours, #23 – Small Family Homes with Comfortable Interiors (video)

Moreover, the rental market is often robust, with a constant demand for housing in many areas. This demand can translate into consistent rental income, ensuring that your property remains a valuable asset. By setting competitive rental rates and maintaining a well-kept property, you can attract reliable tenants and minimize vacancy periods, further enhancing your financial returns.

However, becoming a landlord is not without its challenges. There are essential rules and pitfalls that prospective landlords must be aware of to ensure a smooth and profitable rental experience. Understanding local rental laws, tenant rights, and property management best practices is crucial to avoid legal complications and financial losses. Additionally, implementing thorough tenant screening processes and maintaining open communication with renters can prevent common issues and foster positive landlord-tenant relationships.

This blog post will delve into the key aspects of renting out your home, offering practical advice and insights to help you navigate the rental market successfully. From understanding legal requirements to optimizing your rental property, we will cover everything you need to know to earn extra income with minimal effort.

Renting out your property can present numerous financial benefits, making it an attractive option for homeowners. One of the primary advantages is the potential for passive income. By leasing your property, you can generate a steady stream of rental income which can substantially augment your primary earnings. This regular cash flow can cover mortgage payments, property maintenance costs, and even contribute to savings or other investments.

Another significant financial benefit of becoming a landlord is the array of tax advantages available. Landlords can often deduct expenses related to the upkeep and management of rental properties, such as property taxes, mortgage interest, insurance premiums, and repair costs. Additionally, depreciation deductions can be applied to the property over time, further reducing taxable income and enhancing overall profitability.

Moreover, renting out property can lead to appreciation in property value over the long term. As the real estate market fluctuates, property values generally tend to increase, providing an opportunity for capital gains when the property is eventually sold. This appreciation, combined with rental income, can significantly boost the financial return on investment for landlords.

Consider the scenario of a homeowner who rents out a portion of their house. Suppose they charge $1,500 per month for rent. Over a year, this generates $18,000 in rental income. If the homeowner’s annual mortgage payment is $12,000, the rental income can cover the mortgage and leave an additional $6,000 for other expenses or savings. Additionally, they can benefit from various tax deductions, potentially saving thousands more on their annual tax bill.

In summary, the financial benefits of becoming a landlord extend beyond just earning rental income. Tax advantages and property appreciation can further enhance the profitability of renting out your property. By carefully managing rental property, homeowners can enjoy a reliable supplementary income source and long-term financial gains.

Legal Requirements and Regulations

When considering renting out your house, it is essential to understand and adhere to the legal requirements and regulations that govern the landlord-tenant relationship. Compliance with these laws not only protects you as a landlord but also ensures the rights and safety of your tenants.

One of the fundamental aspects of renting out a property is understanding landlord-tenant laws. These laws vary by jurisdiction, so it is crucial to familiarize yourself with both local and state regulations. These laws typically cover various aspects, such as security deposits, rent control, eviction procedures, and tenant privacy rights. Ignorance of these laws can lead to legal disputes and significant financial penalties.

A well-drafted rental agreement is another critical component. This legally binding document outlines the terms and conditions of the tenancy, including rent amount, payment schedule, duration of the lease, maintenance responsibilities, and rules regarding property use. It is advisable to consult with a legal expert to ensure that your rental agreement complies with local laws and adequately protects your interests as a landlord.

Property licensing is another area that potential landlords must consider. Some municipalities require landlords to obtain a rental license or permit before leasing their property. This process may involve property inspections to ensure that the rental unit meets safety and habitability standards. Failing to obtain the necessary licenses can result in fines and legal complications.

Understanding and adhering to local, state, and federal regulations is paramount for a smooth and lawful rental experience. Federal laws, such as the Fair Housing Act, prohibit discrimination based on race, color, national origin, religion, sex, familial status, or disability. Ensuring compliance with these regulations not only fosters a fair renting environment but also shields landlords from potential lawsuits.

By comprehensively understanding the legal landscape, landlords can minimize risks and create a positive rental experience for both themselves and their tenants. Taking the time to educate oneself on these requirements is a crucial step towards successful property management.

Preparing Your Property for Rent

Renting out your house can be a lucrative venture, but it requires careful preparation to ensure the property attracts quality tenants and maintains its value. The first step in preparing your property for rent is to address any necessary repairs. This includes fixing leaky faucets, patching up damaged walls, and ensuring all appliances are in working order. A well-maintained property not only appeals to prospective tenants but also minimizes the likelihood of future maintenance issues.

Ensuring the property is safe and habitable is paramount. This means checking that smoke detectors and carbon monoxide detectors are functioning correctly, the electrical system is up to code, and the plumbing is in good condition. It’s also essential to make sure that the property complies with local rental regulations, which may include specific requirements for safety and habitability.

Enhancing the appeal of your property can significantly impact its rental potential. Cleanliness is crucial; a spotless home gives a good first impression and sets the standard for how you expect tenants to maintain the property. Consider a deep clean of carpets, floors, windows, and all surfaces. Additionally, a fresh coat of paint can make the space look new and inviting.

Functionality is another critical aspect. Ensure that all systems, including heating, cooling, and plumbing, are in top working condition. If any appliances are outdated, consider upgrading them to improve the property’s appeal and functionality. Energy-efficient appliances can also be a selling point for environmentally conscious tenants.

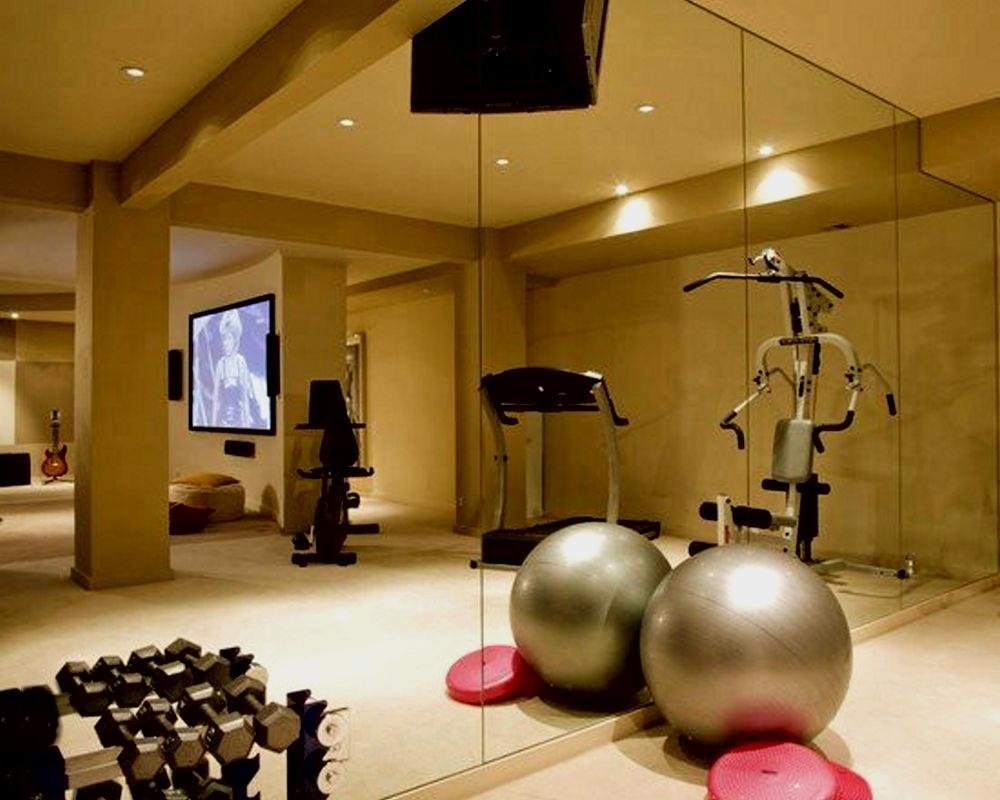

Staging the home, although not always necessary, can be a beneficial step. This involves furnishing the property in a way that highlights its best features and helps prospective tenants visualize living there. Even simple touches like strategically placed furniture, tasteful decorations, and adequate lighting can make a significant difference.

By meticulously preparing your property for rent, you set the stage for attracting reliable tenants who will respect and care for the home. This not only ensures a steady rental income but also helps maintain and potentially increase the property’s value over time.

Setting the Right Rent Price

Determining the appropriate rental price for your property is a critical step in ensuring that you attract the right tenants while maximizing your rental income. Several factors should be considered to set a competitive and fair rent price. The location of your property is paramount; properties situated in desirable neighborhoods often command higher rent due to proximity to amenities such as schools, parks, shopping centers, and public transportation. Additionally, the condition of your property plays a significant role. Well-maintained and updated homes tend to attract higher rental rates compared to those that require significant repairs or upgrades.

Market demand is another crucial factor to consider. In areas with high demand for rental properties, you may have the leverage to set a higher price. Conversely, in markets with an abundance of rental options, pricing competitively becomes essential to avoid prolonged vacancies. Conducting thorough market research is vital to understanding the going rates in your area. This can be done by analyzing similar properties on rental listing websites, attending open houses, and even speaking with other landlords. Comparing rental prices for properties with similar attributes, such as size, number of bedrooms and bathrooms, and included amenities, will help you gauge a fair and competitive rent price.

Consulting with a real estate professional can provide additional insights and expertise. Real estate agents have access to comprehensive market data and can offer a more precise evaluation of your property’s rental value. They can also advise on current trends and future projections in the local rental market. Setting the right rent price involves balancing your financial goals with market realities, ensuring you attract quality tenants while maximizing your property’s earning potential.

Finding and Screening Tenants

Finding and screening potential tenants is a crucial step in the process of renting out your house. The quality of your tenants can significantly affect your rental income stability and the overall experience of being a landlord. To start, effective advertising strategies are essential for attracting a pool of interested renters. Utilize online platforms such as rental listing websites, social media, and community boards. Additionally, consider traditional methods like local newspapers and word-of-mouth referrals to reach a broader audience.

Once you have a list of potential tenants, the next step is to conduct thorough background checks. This process includes verifying employment and income, checking credit history, and reviewing rental history. Employment verification ensures that the tenant has a stable source of income, which is crucial for consistent rent payments. Checking credit history can provide insight into the tenant’s financial responsibility and likelihood of paying rent on time. Reviewing rental history can reveal any past issues with previous landlords, such as late payments or property damage.

Interviews are another integral part of the tenant screening process. During the interview, ask questions to gauge the prospective tenant’s reliability and responsibility. Inquire about their reason for moving, the number of occupants, and their lifestyle to ensure they are a good fit for your property. It’s also an opportunity to set clear expectations regarding rental terms, maintenance responsibilities, and house rules.

Choosing reliable and responsible tenants minimizes future issues such as missed payments, property damage, and disputes. It is essential to be diligent and thorough during this process to ensure a positive and profitable rental experience. By implementing effective advertising strategies, conducting comprehensive background checks, and interviewing prospects, you can find tenants who will contribute to the stability and success of your rental property.

Managing Your Rental Property

When renting out your house to generate extra income, managing the rental property efficiently is paramount. One of the significant responsibilities is property maintenance. Regular upkeep ensures that the property remains in good condition, preventing costly repairs in the future. This includes routine inspections, addressing wear and tear, and promptly fixing any issues that arise. Additionally, maintaining the property’s exterior, such as landscaping and ensuring the curb appeal, can attract and retain tenants.

Handling tenant requests is another critical aspect of property management. Tenants may have various needs, ranging from minor repairs to significant concerns about the property. Responding promptly and effectively to these requests not only ensures tenant satisfaction but also fosters a positive landlord-tenant relationship. Open and clear communication channels are essential in this regard, as they help in resolving issues swiftly and maintaining a harmonious living environment.

Ensuring timely rent collection is also a vital part of managing a rental property. Establishing a clear and consistent rent payment schedule helps in avoiding any confusion or delays. Utilizing online payment systems can streamline the process, making it easier for both the landlord and tenants. In cases where a tenant fails to pay rent on time, having a well-defined procedure for late payments and penalties can help in managing such situations effectively.

If the responsibilities of managing a rental property seem overwhelming or if the landlord prefers a more hands-off approach, hiring a property management company is a viable option. These companies specialize in handling all aspects of property management, from maintenance to tenant relations and rent collection. They provide professional services, ensuring that the property is well-maintained and the tenants are satisfied, thereby allowing the landlord to enjoy the benefits of rental income with minimal effort.

Common Pitfalls and How to Avoid Them

Becoming a landlord can be a lucrative way to earn additional income, but it is not without its challenges. New landlords often encounter several common pitfalls that can complicate their rental experience. By being aware of these issues and implementing effective strategies, you can navigate the rental market more smoothly and enhance your profitability.

One major challenge is dealing with problematic tenants. Tenant issues can range from late payments to property damage and disruptive behavior. To mitigate these risks, it is essential to conduct thorough tenant screenings. This includes credit checks, employment verification, and references from previous landlords. A solid lease agreement that clearly outlines tenant responsibilities and consequences for breaches can also serve as a valuable tool in maintaining order.

Unexpected maintenance costs are another significant concern. Properties inevitably require upkeep, and unforeseen repairs can be financially draining. Budgeting for regular maintenance and setting aside an emergency fund can help you manage these expenses more effectively. Regular inspections can also identify potential problems before they escalate, saving you time and money in the long run.

Legal disputes represent a further complication for landlords. Issues can arise from misunderstandings about lease terms, security deposits, or eviction procedures. Familiarizing yourself with local landlord-tenant laws and ensuring that your lease agreement complies with these regulations is crucial. In addition, consider consulting a legal professional for advice on complex matters or when drafting your lease to avoid potential legal pitfalls.

Effective communication with tenants can help prevent many of these issues. Maintaining open lines of communication and addressing concerns promptly can foster a positive landlord-tenant relationship, making it easier to resolve any problems that may arise. By taking proactive steps to avoid common pitfalls, you can create a more seamless and profitable rental experience.

Conclusion: Weighing the Pros and Cons

Renting out your house offers a compelling opportunity to generate extra income with minimal effort, provided you are well-prepared and informed. Throughout this blog post, we’ve explored various aspects of becoming a landlord, from financial benefits to responsibilities and potential challenges. The allure of a steady rental income and the possibility of property value appreciation are significant advantages. Additionally, renting out your house can help cover mortgage payments, maintenance costs, and even provide a supplemental income stream.

However, it is crucial to weigh these benefits against the potential drawbacks. Being a landlord comes with responsibilities such as property maintenance, tenant management, and compliance with legal obligations. Unexpected vacancies, property damage, and tenant disputes can also pose challenges that require time, effort, and financial resources to address. Therefore, it’s essential to have a clear understanding of your personal circumstances, goals, and preparedness before embarking on this journey.

Consider your availability and willingness to manage the property or the feasibility of hiring a property management company. Evaluate your financial stability to cover unexpected expenses and vacancies. Reflect on your long-term goals and how renting out your house aligns with them. By carefully assessing these factors, you can make an informed decision that balances the potential rewards and challenges of being a landlord.

Ultimately, becoming a landlord can be a rewarding venture, both financially and personally, if approached with careful planning and realistic expectations. While there are challenges to navigate, the benefits of earning extra income and maximizing your property’s potential can make the effort worthwhile. Whether you choose to rent out your house or explore other avenues, ensuring that your decision aligns with your overall objectives is key to achieving long-term success.

Other related posts from our website:

https://howtobuildahouseblog.com/how-to-invest-in-real-estate-for-retirement/

https://howtobuildahouseblog.com/how-to-save-large-on-your-real-estate-purchase/

https://howtobuildahouseblog.com/how-to-sell-your-house-without-a-real-estate-agent/

Thank you so much for your attention.

Stay tuned. We will upload many other amazing posts to our website and videos onto our YouTube channel.

Thank you so much.

for your time and attention.

Best Regards

See you to another post,

Bye, Bye

No Responses